| |

What is the impact of Brexit?

Brexit immediately reduced the 15-year gilt yields from 1.93% just before the EU Referendum to an all time record low of 0.90% on 11 August 2016, after the Bank of England reduced interest rates to 0.25% and announced more quantitative easing buying £60 billion of UK government gilts and £10 billion of corporate bonds.

The reason for the fall at the time was uncertainty over the UK economy as a result of Brexit as investors seek safe havens in bonds and gilts driving the price higher and yields lower.

Annuity rates are mainly based on these gilt yields and a fall of 103 basis points would usually result in a decrease in annuities by 10.3% at some point from providers.

Since Brexit annuity rates have recovered on average by 55% with 15-year gilt yields at about 5.03%.

Annuity income is at a sixteen year high by April 2025 and are likely to remain higher for longer. This could be the ideal opportunity to lock-in secure income for the future.

Review your options at State pension age

Using a more flexible retirement plan such as a fixed term annuity would allow you to avoid economic uncertainty and allow the opportunity for markets to recover in the future.

If you are yet to receive your State pension selecting a term after this date, usually age 65 to 66, would be an ideal time to review your circumstances.

What is a fixed term annuity?

A fixed term annuity is also known as a fixed term plan and is written under drawdown rules so you can retain your fund at the end of the term. It is available for anyone over the aged 55 and allows you to take income and keep control of your fund.

In contrast, a lifetime annuity provides an income in exchange for your fund and you cannot change this even if your circumstances change in the future.

A fixed term annuity lets you take your 25% tax free lump sum and the remainder of the fund sits in a tax efficient pension plan

where you can receive a guaranteed fund at the end of the term.

It can be accessed if you are a UK resident, a resident of another country including the United States as long as you have a UK bank account.

You can take any level of income from the plan over a term from 1 year or more. Some providers include a flexible cash account to the plan allowing you to vary the income if your circumstances change in the future. While in the cash account your money remains in the pension and would not be taxed until you decide to take the income.

It is possible to take the full fund over a specific period of time and deplete the fund which could be useful to reduce the amount of tax by spreading the income over a number of tax years.

You can receive a guaranteed maturity value at the end of the term with all your options available at that time such as buying another fixed term annuity, a lifetime annuity or flexi-access drawdown from any provider.

The underlying assets are invested in gilts and corporate bonds offering a guaranteed return to the end of the term. There is no investment risk and the return improves with longer terms of 5 to 10 years which are generally between 2.0% to 2.5% per year.

What can you do with the fund

There are four popular strategies with a fixed term annuity to give you income and/or a guaranteed maturity value over time as follows:

|

Take full fund - Take the maximum income for a number of years with no guaranteed maturity value. |

| |

|

|

Similar annuity income - Match the income from a lifetime annuity for a specific period of time. |

| |

|

|

Specific income - Decide on a specific income you will need over the term you select. |

| |

|

|

£Nil regular income - After taking your tax free cash with no regular income and delay a decision until a later date. |

| |

|

By remaining in a pension environment the fund benefits from tax free growth

from the maturity value and guaranteed returns of 2.0% to 2.5% per year for longer term plans.

Flexible cash account

Some providers of fixed term plans include a cash account for greater flexibility where you choose to select an income. This will give you the opportunity to reduce the level of income you take should your circumstances change in the future.

The future is uncertain so if you started working part time, sold a property, cash-in an investment or received an inheritance

and did not require the income at that time, the income from the fixed term plan can remain in the cash account.

As soon as income is paid to you marginal tax would be deducted, however, if placed in the cash account the income remains in a pension without a tax deduction.

At a later date you could take part or the full amount remaining in this account and pay marginal rate tax at that time.

If you decided to set-up the fixed term plan on a £Nil income basis, it may be more useful to take an income and place this in the cash account to give you the flexibility to access funds during the fixed term if needed.

Benefits of the plan

|

Take your tax free lump sum now. |

| |

|

|

Popular terms are 1, 3, 5 and 10 years although any number of years is possible. |

| |

|

|

Select an income suitable for your needs from £nil up to any amount. |

| |

|

|

Add a flexible cash account to allow you to vary the income if your circumstances change in the future. |

| |

|

|

Take your full fund over two or more years to minimise your tax liability. |

| |

|

|

Offers the flexibility to consider your options again such as a lifetime annuity, fixed term annuity or drawdown. |

| |

|

|

Receive a guaranteed maturity value (GMV) at the end of the term. |

| |

|

|

Move the fund to any provider without charge at the end of the term. |

| |

|

|

Your fund is invested in government gilts and not exposed to investment risk. |

| |

|

|

You can add protection to the plan in the event of early death to ensure it is transferred to your spouse or beneficiaries. |

| |

|

|

Avoid buying a lifetime annuity now when rates are near an all time low. |

| |

|

|

You do not have to give your capital away to an insurance company in exchange for an income. |

|

Annuities to rise with interest rates

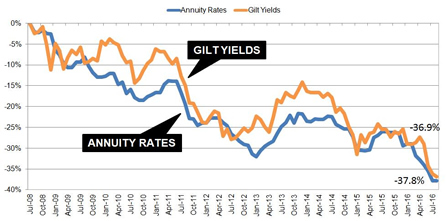

Annuity rates are based on

15-year gilt yields which increase with rising interest rates. Rising 1.5% yields would be about 150 basis points higher and annuities would improve by 15.0%.

The following chart shows how annuity rates have reduced and closely followed gilt yields since the financial crisis.

|

| Source: Sharingpensions.co.uk research based on annuity rates and gilt yields in July 2008 and the changes over time and recent improvements. |

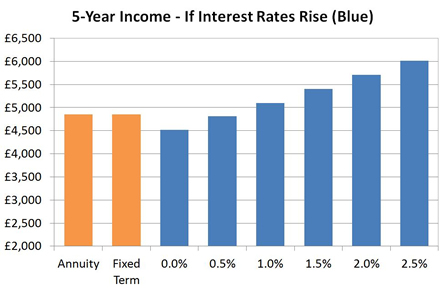

For a 60 year old with a fund of £100,000 a lifetime annuity on a 100% joint life, monthly advance and level basis pays an income of £4,850 pa.

As an example, this income of £4,850 pa is matched by the fixed term plan over a 5-year term and the following chart shows the effect of a rise in interest rates of between 0.0% to 2.5% in five years time if you then buy a standard annuity.

|

| Source: Sharingpensions.co.uk research for a 60 year old with an income of £4,850 pa for 5 years. This is followed by an annuity based on interest rate rises by this time from 0.0% to 2.5%. |

A five year fixed term annuity can provide any level of income, however, if you select an income of £4,850 pa you will receive a guaranteed maturity value of £86,210 at the end of the term. With interest rates rising by 1.5% from current levels, annuities could increase by 15% providing a lifetime annuity of £5,401 pa.

What you will receive back

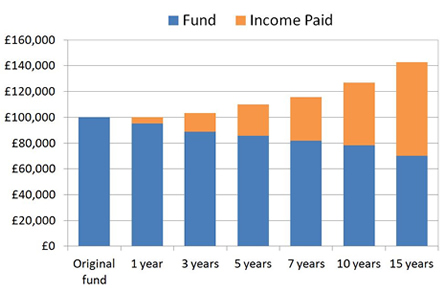

The fixed term plan is designed to provide an income over a term selected by you. As an example, a 60 year with a fund of £133,333.34 could take a tax free lump sum now leaving £100,000 for a fixed term plan.

The income from a lifetime annuity on a 100% joint life, monthly advance and level basis is £3,640 pa. The fixed term plan can also match this amount with a guaranteed maturity value at the end of the of terms in the example from one to fifteen years. The longer the time period the better is the return.

|

| Source: Sharingpensions.co.uk research for a 60 year old with a fund of £100,000 on a single life with 100% value protection and monthly in advance. Combination of GMV at the end of the term and income of £3,640 pa paid over different terms. |

Income from the fixed term plan can be taken from £Nil to any upper amount and in the example is compared to a lifetime annuity of £3,640 pa based on a 100% joint life payable monthly in advance.

For the fixed term annuity, the total return varies and improves with longer terms from 5.0% over five years, 9.0% over ten years to 17.3% over fifteen years.

Over a five year term the total value would reach £105,061 and pay total income from this of £18,200 leaving a residual fund of £86,861.

Exit the plan early without penalty

The fixed term you select should be the ideal time you would like to consider your options again. However, circumstances can change and if you do need to buy a lifetime annuity earlier, such as due to poor health you can exit the plan at this time without penalty.

The fund you receive will be based on your age, the income you have received up to that point and the value of the underlying assets used to provide the guaranteed maturity value at the end of the term.

The change in the value of gilts, corporate bonds and other assets would determine if it was in your interest to exit at that time.

Protecting the fund for your family

The fixed term annuity can offer protection for your family in the event of early death to ensure the income continues or fund is not lost. The usual additions are as follows:

| • |

Add a joint life to benefit your spouse |

| • |

Add value protection to benefit your family |

| • |

Add a guaranteed period for income to continue |

By adding a 100% joint life benefit the income will continue to your spouse for the term selected and at the end of the term the guaranteed maturity value will be available.

The spouse will then have the choice of taking another fixed term plan, lifetime annuity from any provider, flexi-access drawdown or any other pension arrangement available at that time.

If the fixed term annuity is for a single life you could add 100% value protection. In the event of early death the original fund less income paid to date would be paid to date will be paid to your spouse or returned to your estate if you are single where it can be paid to your children.

If you wanted the income from the plan to continue for a fixed period of time, such as the full term of the plan, add a guaranteed period. Income would be paid to your nominated beneficiary or your estate although at the end of the term there would be no guaranteed maturity value.

|

About Sharing Pensions

Sharingpensions.co.uk was created by its founder Colin Thorburn in 2001 to provide a free pensions and annuity resource to hundreds of thousands of people at retirement making their decision making easier and to select the best options.

Colin Thorburn has nineteen years experience in pensions and annuities, is an individual authorised by the Financial Conduct Authority and business is submitted through Blackstone Moregate Ltd which is authorised and regulated by the FCA (no. 459051).

|